Introduction

The Petroleum Host and Impacted Communities Development Bill 2018 (the “Host Community Bill” or the “Bill”) is made up of six parts, twenty-seven sections on 15 pages. The Bill is formally titled “A Bill for: An Act to provide for Petroleum Host and Impacted Communities Development Trust, Incorporation of Petroleum Host and Impacted Communities Trusts and for other related matters.”

Objectives of the Bill

Section 1 of the Bill details its objectives which are, to foster sustainable shared prosperity and provide direct social and economic benefits from petroleum operations to host and impacted communities; and to enhance peaceful and harmonious coexistence between Settlor and host and impacted communities.

PETROLEUM HOST AND IMPACTED COMMUNITIES DEVELOPMENT TRUST

By virtue of Section 2 of the Bill, a Settlor is defined as “a company or companies with an interest in a licence to prospect for and/or produce petroleum or licensee of Designated Midstream Assets or Downstream Assets whose area of operations are located in or appurtenant to any community or communities”.

The Section further provides that a settlor is required to incorporate a Petroleum Host and Impacted Communities Development Trust (“PHICDT” or “the Trust”) for the benefit of the community or communities within its area of operations. The Settlor is required to appoint and authorize a body of trustees (Board of Trustees) who will apply to CAC for the registration of the Trust as a body corporate.

The main objectives of the Trust among others include:

- To finance and execute projects for the benefit and sustainable development of the Settlor’s host and impacted communities;

- To support healthcare development for the Settlor’s host and impacted communities;

- To facilitate economic empowerment opportunities in the Settlor’s host and impacted communities; and

- To undertake the infrastructural development of the Settlor’s host and impacted communities within the scope of funds available to the Board of Trustees for such purposes.

The Timeframe for Incorporation and Consequences of Failure

The timeframe within which the Trust is to be incorporated is as follows:

- For existing oil mining lease and holders of Designated Midstream and Downstream Assets (petroleum terminals, crude oil and gas pipelines, refineries, petrochemical plants, gas processing plants) the Trust shall be incorporated within twelve (12) months of the commencement of the Bill;

- For existing oil prospecting licences, and upstream licences granted pursuant to the provisions of the Petroleum Industry Administration Bill, the Trust shall be incorporated prior to the application for Field Development Plan; and

- For holders of Designate Midstream and Downstream Assets granted by the provisions of the Petroleum Industry Administration Bill, the Trust shall be incorporated before the commencement of commercial operations.

Failure to incorporate the Trust will be a ground for suspension of the licence by the Nigerian Petroleum Regulatory Commission (“Commission”), the body responsible for issuing and administering licenses and leases by virtue of the Petroleum Industry Governance Bill.

Sources of Funding for Trust and Allocation of the Funds

The constitution of the Trust shall contain provisions which require the Trust to provide an Endowment Fund in which monies from the following sources are paid:

- An annual contribution of an amount equal to 2.5% (two and a half percent) of the actual operating expenditure (OPEX) of the Settlor for the accounting period of the preceding year relating to the Settlor’s operations in the particular licence or lease area for which the Trust is established.

- Donations, loans, grants or honorarium that are extended to the Trust for the attainment of its goals.

- Incomes derived from the interest or profits of Reserved Funds (a sum equal to 20% of the Endowment fund allocated and sequestered for savings and investment for the use of the Trust when a cessation in the endowment payable by the Settlor occurs).

- Any other income granted to the Trust for the attainment of its goals.

The funds shall be allocated in the following manner:

- A sum equal to 70% shall be allocated to the Capital Fund which shall be disbursed by the Board of Trustees for projects in each host and impacted community as may be determined by the Management Committee. Any sum not utilised shall be rolled over and utilised in later years.

- A sum equal to 20% shall be allocated to the Reserve Fund to be invested for the use of the Trust when there is a cessation in the endowment payable by the Settlor.

- A sum equal to 10% shall be allocated to the Settlor’s Special Project Fund solely to aid and support host and impacted communities, provided that the Settlor renders a full account of the use of the Special Project Fund to the Board of Trustees at the end of each financial year. Any fund not utilised shall be returned to the Capital Fund.

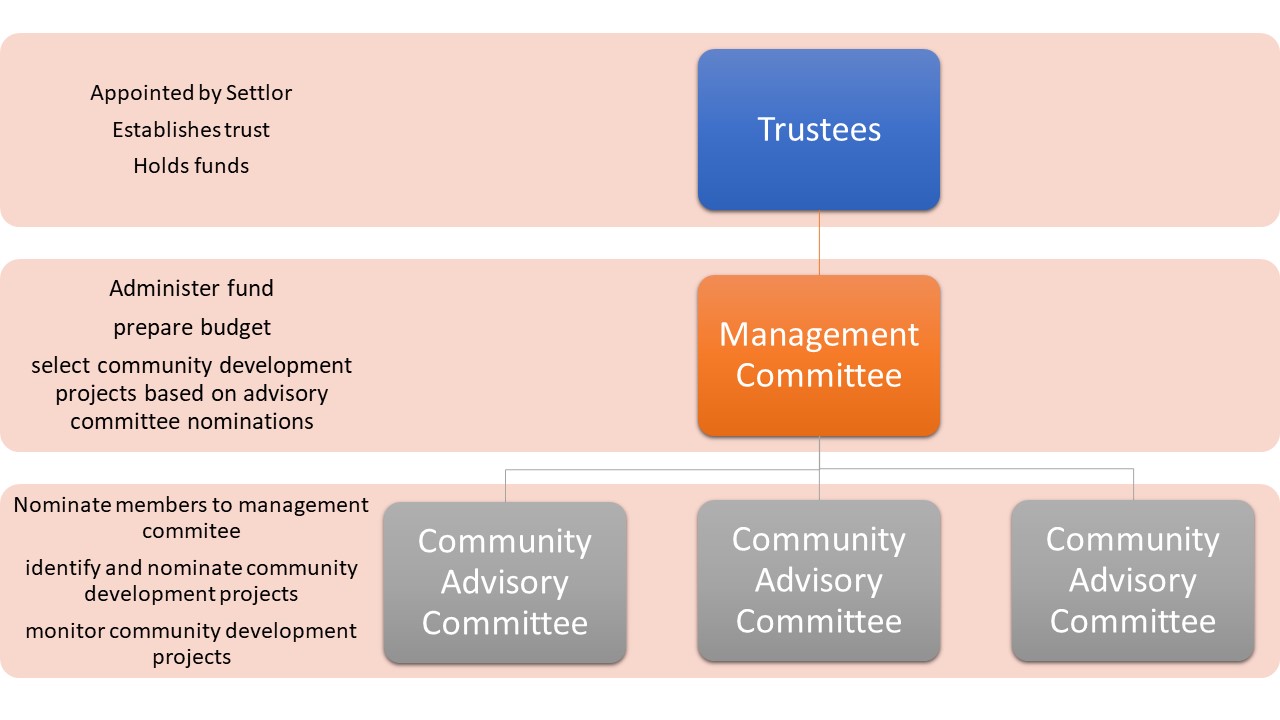

Governance of the Trust

Section 9 of the Bill provides that the Board of Trustees shall be responsible for the general management of the Trust. The Settlor shall decide the membership of the Board of Trustees and the criteria for appointment to the Board. The term of members of the Board of Trustees shall be four (4) years at the first instance with an option for re-appointment for another four (4) year term only. The duties and functions of the Board among others shall include:

- Receiving and managing funds of the Trust;

- To determine the criteria, process and proportion of the fund to be allotted for the development of each host and impacted community;

- Approval of projects for which the funds will be utilised;

- Provide general oversight of the projects for which the funds shall be utilised;

- Set up a Management Committee which shall be responsible for the administration of the Trust.

The Management Committee shall perform the following functions:

- Determine and prepare the budget of the Trust and send to the Board of Trustees for approval;

- Determine and prepare the budget of the Trust and send same to the Board of Trustees for approval;

- Develop and manage the contrasting processes for project award for the Trust;

- Supervise the execution of projects;

- Nominate fund managers for managing the Reserve Fund of the Trust and send same to the Board of Trustees for appointment.

The Management Committee shall be mandated by the constitution of the Trust to set up a Petroleum Host and Impacted Community Advisory Committee. The functions of the Advisory Committee are nomination of members to represent the host and impacted community on the Management Committee; articulate and determine community development projects to be transmitted to the Management Committee; monitor and report progress of projects being executed; advise the Management Committee on activities that will lead to improvement of security of infrastructure within the community; and take responsibility for first line protection of facilities and ensure petroleum operations are not interrupted by members of their communities failing which benefits from the Trust will be disallowed.

Accounts, Audit and Mid-Year/Annual Reports

The constitution of the Trust shall contain provisions which require the Board of Trustees to keep account of the financial activities of the Trust, as well as the appointment of auditors to audit the accounts of the Trust annually.

Furthermore, the constitution of the Trust shall contain the following provisions which require:

- The Management Committee to submit a Mid-year Report of its activities to the Board of Trustees latest by the 31st of August of the particular year;

- The Management Committee to submit an annual report accompanied by its audited account to the Board of Trustees by the 28th of February of the succeeding year;

- The Board of Trustees to submit an annual report of the activities of the Trust accompanied by its audited account to the Settlor no later than 31st of March of the particular year; and

- Submission of the annual report and audited account of the Trust by the Settlor to the Commission not later than the 31st of May of the particular year.

Section 20 of the Bill stipulates that the provision of the annual reports above are subject to the provisions of Section 587 of the Companies and Allied Matters Act.

Tax Exemption & Deductibility

Funds of the Trust created pursuant to the Bill are exempt from taxation. The contributions of Settlors are however deductible for the purpose of calculating Petroleum Income Tax and Company Income Tax.

Dispute Resolution

In the event a dispute arises between persons subject to this Bill and between such persons and other persons regarding any matter under this Bill, Parties are obligated to resolve such dispute first through negotiation.

The Commission is empowered to resolve such disputes and shall make regulations setting out the principles and procedures for conciliation, mediation or arbitration that it may adopt in resolving disputes referred to it under the provisions of this Bill.

A party dissatisfied with the determination of the Commission has a right of appeal to the Federal High Court. However, such determination shall subsist and remain binding on the parties until an order of Court is granted expressly reversing such determination.

Transfer of Existing CSR Projects or Schemes

By virtue of Section 25 of the Bill, Settlors are entitled to transfer existing CSR Projects or Schemes to a Trust established pursuant to the provisions of the Bill. The Settlors are however required to notify the Commission upon such transfers. The Settlors are also entitled to continue with any ongoing CSR Projects or Schemes, and any financial contribution made towards such Projects or Schemes will be deemed to form part of the annual contribution of an amount equivalent of 2.5% of the actual operating expenditure required to be made by the Settlor, for a period of two (2) years from the commencement of this Bill.

Financial Implications for Setting up the Trust

The financial implications for setting up the fund is incident on the Settlor. The funding for administration, projects and other matters to be undertaken by the Board of Trustees, the Management Committee and the Host and Impacted Community Advisory Committee are not to be provided by the government. There shall, therefore, be no requirement for financial expenditure in respect of the incorporation of the Trust or its related activities.